Cost of living in London

Cost of living in London

In 2015, I decided to relocate from Singapore to London. At the time I had no idea about the cost of living, the places where I should rent and places where the groceries would be the cheapest.

Fast forward to today, March 2017, I moved back from London to Singapore. I stayed around London for more than a year and a half and while I was there, I kept an extremely close look to every in and out from my bank account. I even created an app Expense King to track my expenses coming out from my bank account.

Today I would like to share what I wish someone would have shared before I relocated, a post about cost of living in London. This post will be composed by 5 parts:

1. Situation

2. Recurring expenses

3. Rent a place

4. Bills

5. Grocery shopping1. Situation

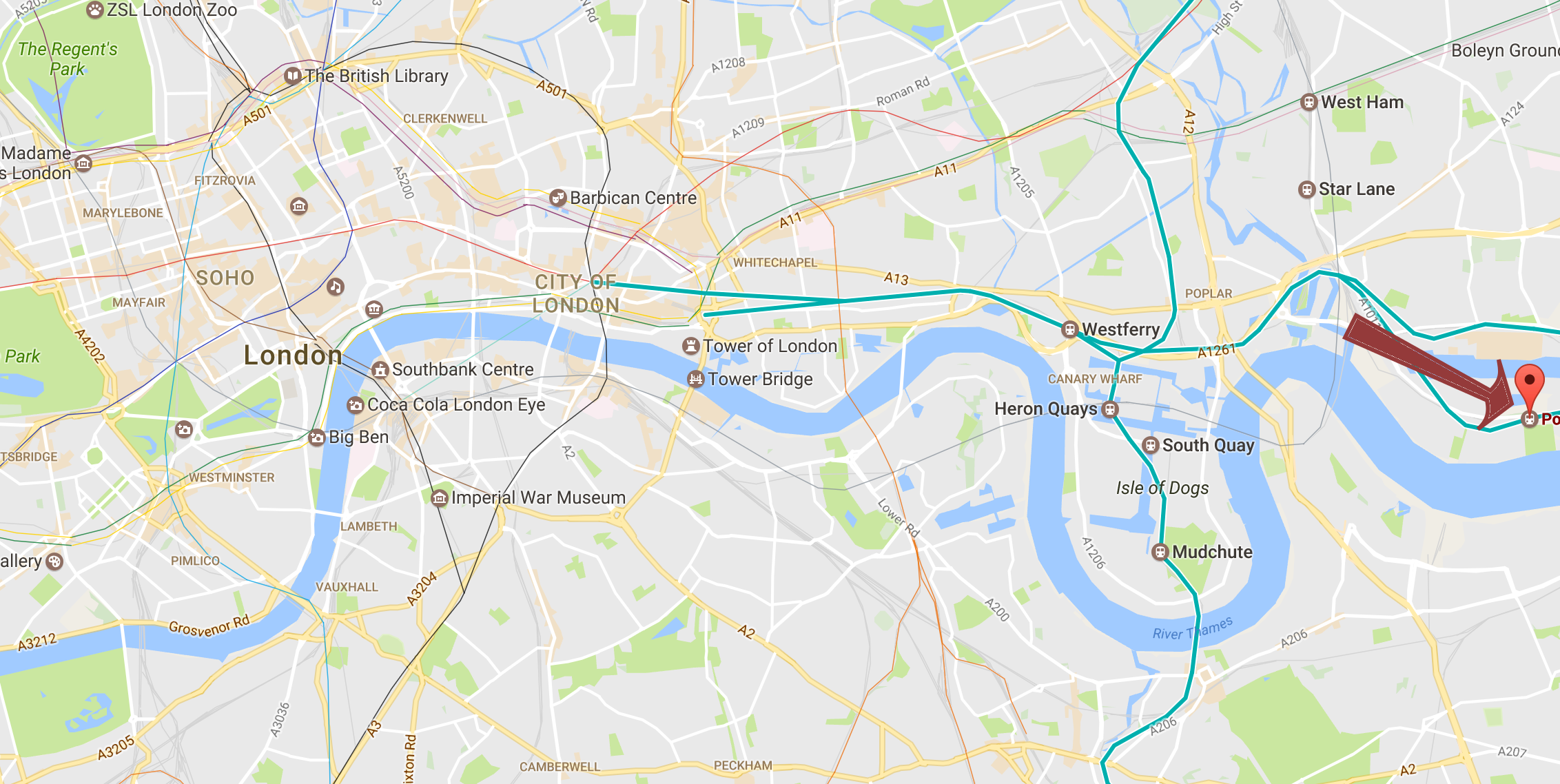

My fiancee and I lived in a one bedroom apartment. The apartment was located at Pontoon Dock on the east of Canary Wharf with access to the DLR (but not the underground). It is about 40min by DLR+underground from Bank station.

I was working from home and didn’t need to take transport everyday.

We mostly ate home lunch and dinner with occasional dinners at restaurant.

Even though your situation will be different, I am very sure that some expenses will be similar if you are planning to relocate as a couple or even as a single person.

2. Recurring expenses

Recurring expenses include rent, bills, taxes, groceries and transport.

- Rent of our 1 bedroom was at 1250 GBP pcm.

- All bills and tax together was at 250 GBP pcm.

The apartment was a one bedroom. Located in one of the cheapest area, at that time, on the east of London. 1250 pcm will be one of the cheapest rent that you will be able to find if you do not wish to share like us and decide to take a 1 bedroom apartment.

Living with my fiancee, we mostly ate at home. Our average monthly groceries spending was of 450 GBP.

- Average monthly groceries spending was of 400 GBP pcm.

I was working from everyday so our transport spending was limited to going to buy groceries which adds up as a monthly expense to about 100 GBP for two.

- Average monthly transport spending was of 100 GBP pcm.

Those recurring expenses add up to 2000 GBP pcm which had to be spent in order to live.

3. Rent a place

We found our apartment with Foxtons. We had a lot of issues in finding an apprennent to rent as we did not have any credit history. Any rent is subject to credit check. Failing credit check would result in a rejection from the landlord.

I am not sure about having a direct contract with landlord.

Our apartment was located in Pontoon Dock. The rent was at 1250 GBP pcm with a deposit of 2,5 months. Usual deposits go up to 1,5 months but in our case, with no rent history, we had to negotiate with the landlord to give her a higher security in exchange of her trust.

Side note: We saw a lot of horror stories about deposit not returned but our deposit was refunded within three weeks after we vacated the property without any issues.

As stated in 2), 1250 GBP will be in the lower range of prices for one bedroom apartment. We were quite far from the center of London and there was nothing walking distance accessible.

We stayed where the red arrow points:

4. Bills

The bills to consider were:

- gas and electricity

- council tax

- mobile phones

internet

- Gas and electricty was about 50 GBP per month for two persons.

- Council tax was of 110 GBP - everyone has to pay the council tax, the price is for the whole home and will depend on which area you will live in.

- Mobile phones, we used Giffgaff, Giffgaff is by far the best option for mobile plans, we were having a package of 500mb of data for 7.5GBP per month with unlimited call to other Giffgaff numbers. 500mb was enough for us as we stayed home most of the time.

Lastly for internet, we used Hyperoptic with a 20gb connection for 31 GBP per month.

Really really check Giffgaff as they are the most, if not the only, honest provider.

https://www.giffgaff.com/

I had an issue where I forgot (It was my mistake) to disable a recurring payment and after one phone call they refunded me. I doubt that any other provider would have done the same.

This is what my monthly rent + bills looked like:

Screenshot from Expense King

5. Groceries

For groceries, we used to buy groceries from:

- Tesco

- Waitrose

- Sainsburry

- Asda

Living in Pontoon Dock, we could access to Tesco at Woolwich arsenal via DLR.

For Waitrose and Sainsburry, they are both located at Stratford which we could access via DLR. Lastly we used Asda for home delivery to deliver heavy items like water bottles.

Waitrose is the most expensive of all place to buy groceries but the quality of the meat is superior. Tesco would be the second place where we bought most of our food.

As mentioned earlier, our spending per month in supermarket average around 400 GBP pcm.

This is an example of how often we bough groceries:

Screenshot from Expense King

Conclusion

London is a great city, with lot of history and places to explore. But coming as a tourist versus coming to live there is a total different atmosphere.

In order to live in your own apartment, like us, be ready to fork out of your wallet 2000 GBP per month.

My advice would then be, if someone wants to recruit you to move to London, consider how much you would spend just to live, and top this up on top of your salary. Otherwise you will not be able to enjoy which will then ruin the magic of London. Again this was my personal experience, I am sure yours will be different but I hope this have helped you get a closer idea of what to expect to pay to live in London! If you have any question, leave it here or hit me on Twitter @kimserey_lam. See you next time!

Comments

Post a Comment